Solutions

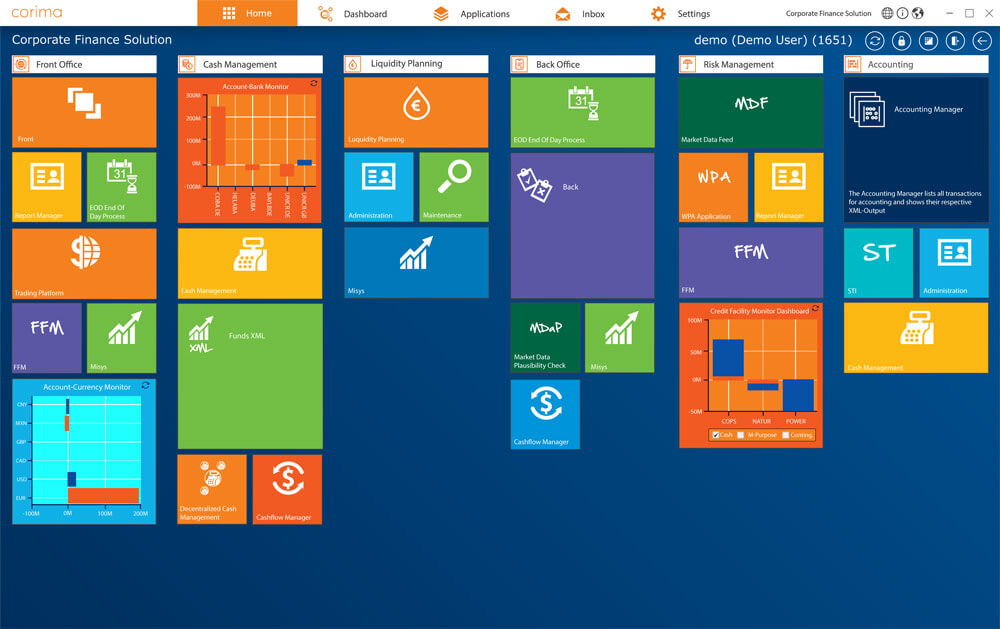

cash management

The cash management functionality supports you in the course of receipt, administration and transfer of payments for optimising payment transactions in the whole company.

back office

The back office solution helps you to process your financial transactions and control your treasury business workflow.

risk management

The risk management application helps you analysing and controlling your financial risks.

front office

In the front office solution you can enter your financial transactions quickly and flexibly and obtain an overview of the current status of your treasury positions.

liquidity planning

The financial status and liquidity planning applications will facilitate efficient display and planning of your liquidity position.

accounting

In the accounting module you can implement booking concepts on the basis of national and international requirements in parallel and integrate them in the overall treasury process.

36th Finance Symposium | May 21-23, 2025 | The COPS - Program Highlights!

This year will be a memorable Finance Symposium. For the ...

Read moreCOPS success story: 20 years of corima.PMS at Wüstenrot

Wüstenrot & COPS – eine langjährige Partnerschaft Die österreichische Wüstenrot-Gruppe ...

Read moreCOPS-Success-Story: Erfolgreiche Automatisierung des FX-Netting-Prozesses mit corima bei der voestalpine

Die voestalpine ist ein weltweit führender Stahl- und Technologiekonzern mit ...

Read more

Process

Application profiles

Flexible deposit of application profiles on group and user level

Integrated master data model

Integrated master data model for all modules and applications (from front office to liquidity planning)

Authorisation concept

Homogeneous authorisation concept for all system functions

Daten und Berichtskonzept

Definiertes Output- Daten und Berichtskonzept

Systemoberflächen

Synchrones Konzept zur Gestaltung der Systemoberflächen

Einheitliches Schnittstellenkonzept

Einheitliches Schnittstellenkonzept zur Anbindung vor- und nachgelagerter Systeme

Abbildung/Steuerung von Treasury-Abläufen

Abbildung/Steuerung von Treasury-Abläufen durch Kombination von Systemmodulen

-

Thomas Eckhardt, Product Manager

Thomas Eckhardt, Product Manager

-

Robert Lukas, Partner – Software Engineering

Robert Lukas, Partner – Software Engineering

corima is a real innovation for you. The technology used here offers a wide range of possible solutions and variability in application. In addition to developing innovations and solutions for our customers, our development team works every day on the stability, reliability and performance of the system.

corima is both a client-server application and an application framework. Its special features are a modern look and feel as well as a front and back end that is always at the cutting edge of development. In addition, it includes several standard interfaces to external systems including market data providers, ERP systems or trading platforms. With this and the many years of experience of our specialists in customizing our solutions, corima becomes the control center of your treasury.

Application Cases

- Front to Back Processing

- FX Hegding

- Accounting

- Commodities

- Market Data Connection

- Request-for-Quote Processing

- Trade Finance

- Loans

- Asset Management

- Liquidity Forecast

Customized structuring and automation of your treasury process

- Definition of the relevant transaction type areas (FX derivatives, money market trading, etc.)

- Flexible parameterization of the underlying workflow (from trade entry to the generation of payment media)

- Parameterization of the trade input process (definition of input information, assignment of access rights, etc.)

- Connection to external trading platforms (360T, etc.)

- Automatic matching of payment and booking information (back office & accounting)

- Matching of trade information (incl. connection of matching platforms » Finastra)

Managing your currency risk

- Defining of the relevant hedge exposures (cash flows from operating business and/or financial transactions)

- Detailed integration of cash flows from operating processes into treasury processes (on-balance and off-balance positions)

- Structuring and allocation of exposures from hedging transactions (forward transactions, options)

- Consolidation, monitoring and management of FX risk exposure on a real-time basis

Detailed construction of accounting concepts

- Continuous separation of mandates (support of centralized booking control within the group)

- Parallel posting according to various international posting specifications (HGB/BilMoG, IFRS, US-GAAP, etc.)

- Booking of derivatives (FX, interest, commodities) including operational segment structures (booking based on management/business units)

- Implementation of IFRS posting requirements

– Bewertungs-Segmentierung gemäß IFRS

– Hedge Accounting gemäß IFRS (IAS 39 / IFRS 9)

– IFRS 7 / IFRS 13 - Development of loan accounting concepts (incl. foreign currency valuation)

Commodity exposure management, trading and hedging

- Thorough designing of the commodity hedging process

- Acquisition and mapping of commodity exposures

- Segmentation/allocation of commodity derivatives (build-up of hedging portfolios)

- Import of market and valuation data by direct connection of counterparties (set-up of a market data pool)

- Establishment of a trading and settlement process for commodity derivatives

- Establishment of the net commodity position

- Management of the net commodity position

Integrative market data process

- Provision of a market data package (vwd/Infront)

- Standardized interfaces to the leading market data providers (Reuters - Refinitiv / Bloomberg / Infront (vwd))

- Central management of market data

- Plausibility check of market data movements

- Possibility of data redistribution to downstream systems (ERP, controlling, etc.)

Request-for-Quote (RfQ) – Geschäfte bündeln und Legal Entities anbinden

- Flexible designing of workflows for the input and application process

- Needs-based connection of legal entities, differentiated by transaction type

- Workflow-supported central monitoring, approval and execution

- Supporting dashboards and notifications

- Connection to various external trading platforms

- Applying netting processes

- Automatic processing of transaction data in all connected modules (accounting, cash management, liquidity planning, etc.)

Avale – Management mit Überblick

- Structuring of the application process (3 phases):

1. application: Internal request from subsidiaries

2. processing, verification and control of requests

3. forwarding of the guarantee request to the bank via Swift/pdf - Simple and clear portfolio management

- Control of fee settlement including

1. Utilization and commitment fees

2. Exhibition fees

3. Guarantee commissions

4. Other - Internal and external line management

Capture, process, plan and post loans of virtually any complexity

- Mapping of any loan structures

- Planning of all cash flows over the term and continuous updating with current market data

- Visualization of the interest and repayment schedule

- Cash flow overview

- Syndications

- Full flexibility in adjusting the loan structure during the entire term

- Backup of all contractual documents

- Deposit and management of covenants

- Automatic transfer of all booking records to accounting

Mapping of integrated asset management processes

- Structuring of order workflows

- Standardized connection to external systems (FIX format)

- Communication with custodian banks and asset managers via Swift

- Full integration of asset management workflows into the settlement and booking process

- Portfolio management at custodian and portfolio level

- Calculation of key performance and risk indicators

- Data evaluation via dashboards

Liquiditätsplanung – Alle Cashflows in einem System

- Direct planning

- End-to-end rights management and auditing

- Mapping of any planning scenarios, planning categories, periods and levels

- Single Point of Truth

– Automatische Berücksichtigung sämtlicher Cashflows aus den angeschlossenen Modulen.

– Berücksichtigung aller automatisch generierten zukünftigen Cashflows - Simulation of any scenarios

- Configurable planning process

- Direct and targeted reporting

- Rolling, currency-differentiated planning

corimamagazine

Would you like regular updates on trends, developments in the financial industry and our TMS topics? Then subscribe to our corimamagazine, which will inform you via e-mail about new articles and exciting innovations from our company.